For employees, a merger or acquisition is a lot like The Brady Bunch:

- In The Brady Bunch, the kids had to get used to a new parent having authority. In a merger or acquisition, managers from the other company now have authority.

- In The Brady Bunch, kids who didn’t used to be brothers and sisters were suddenly siblings. In a merger or acquisition, people who used to be competitors are now fellow employees.

- Every household has its ways of doing things. In The Brady Bunch everyone had to figure out the ways of doing things for the new, combined household. In a merger or acquisition, the unwritten rules of how things get done around here aren’t the unwritten rules any more. Or else they are, but just for employees of one of the two companies involved.

- In The Brady Bunch, a laugh track told everyone what was supposed to be funny, even when it wasn’t. In a merger or acquisition, employees are supposed to pretend everything is great even when it isn’t.

Okay, it’s a reach. You try coming up with a brilliant lead every week. It’s a lot like having to write a new sitcom script … oh, never mind.

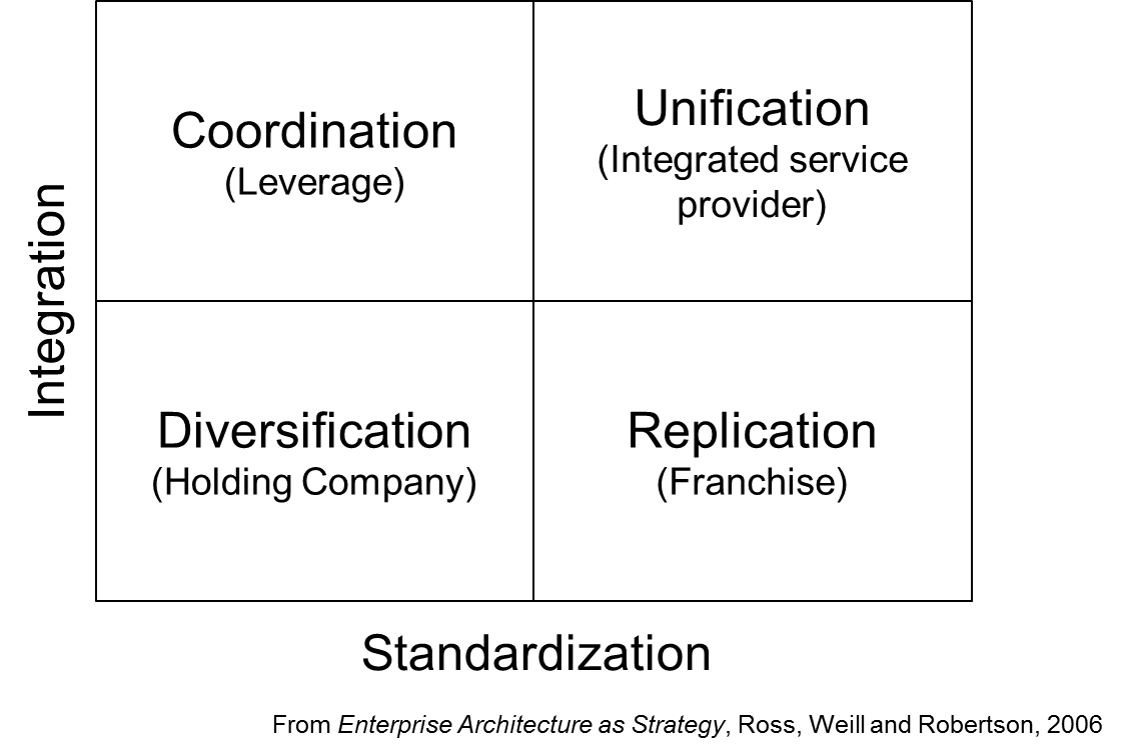

When it comes to mergers and acquisitions, the easiest approach is to operate a holding company, as was mentioned last week. In the extreme case this looks a lot like a mutual fund: The parent company owns a portfolio of businesses, which it mostly leaves alone.

Warren Buffet’s Berkshire Hathaway operates like this. It works. It just isn’t very interesting. In Brady terms, it’s sort of like the backstory of when Mike Brady and Carol Tyler were dating — the Bradys and Tylers were separate households, with all that implies (or implied in the late 1960s and early ’70s).

So let’s skip that part and go to the sort of merger or acquisition that serves a strategic, competitive purpose — one that fills out a product line, provides access to a new set of customers, adds production capacity … that sort of thing. What factors, beyond the usual textbook stuff, determine the success or failure of this sort of merger or acquisition?

One of the most important is both the easiest to understand and the hardest to accomplish: Changing what “we” means. Interestingly enough, the better-led the pre-M&A company, the harder this is.

In companies with excellent leadership, employees feel a strong sense of attachment to their employer. They have an equally strong sense that they personally own the company’s brand, defined as the expectation customers have regarding what it’s like to do business with the company in question.

Imagine a fine company like this … being brand mavens we’ll give it the snappy name Tyler, Inc. … is acquired by the marketplace behemoth The Brady Company.

Brady being what it is, and this being an acquisition, the combined businesses will retain the Brady monicker. Think Tyler’s employees will celebrate their new corporate affiliation?

Of course not. Their loyalty is to the Tyler brand. They identify with it. They live it. And it isn’t the same brand that Brady has — a difference that goes well beyond the name change.

See, Tyler prided itself in the tailored, customized service it gave all of its customers. It encouraged its employees to innovate — to improvise if that’s what made the most sense, so long as the result was something the customer in question would value, and so long as it was profitable, too.

That was the essence of Tyler’s brand, and its customers were happy to pay a premium price for the they-take-great-care-of-me sense of security that went with it.

Brady, in contrast, is all about finely tuned, highly efficient processes built to support standardized products and services. It also encourages employees to innovate — it has an Innovation Committee, in fact, to which its employees are encouraged to submit their ideas, which the IC screens, assesses, ranks, and prioritizes in its quarterly Innovation Planning Meetings.

Think the Tylers will all be happy about becoming Bradys? Of course not.

The sad thing about our mythical scenario is that Brady’s executives acquired Tyler specifically to gain its ability to provide premium service to its customers. What they haven’t done is figure out how exactly they’re going to accomplish this within their signature high-efficiency, product/service standardization practices.

And it gets worse as we look beyond the executive suite, because with increasing distance from the whole point of the acquisition comes an entirely natural attitude:

“We bought them, so of course they have to adapt to our way of doing things.”

* * *

In case you have a suspicious nature and think I’m writing about Dell’s coming acquisition of EMC, or NTT DATA’s coming acquisition of Dell Services, nothing could be further from the truth.

Among the reasons: I have no involvement in the former and as far as the latter is concerned I’m just a passenger on that train — I don’t know anything more about either transaction than you do.